Introduction

The prevailing narrative suggests a seismic shift in consumer search behavior, where the dominance of Google and Amazon is being eroded by a new ecosystem of Social and AI-driven platforms. To move beyond speculation, we built a proprietary dataset, analyzing the detailed purchase journeys of 3,000 UK and US consumers. This data allows us to map the real-world behaviors that define the modern search research journey. Our analysis reveals that while the landscape is diversifying, the story is not one of simple replacement. Instead, the market is fragmenting into three distinct behavioral personas, each with a unique research DNA:

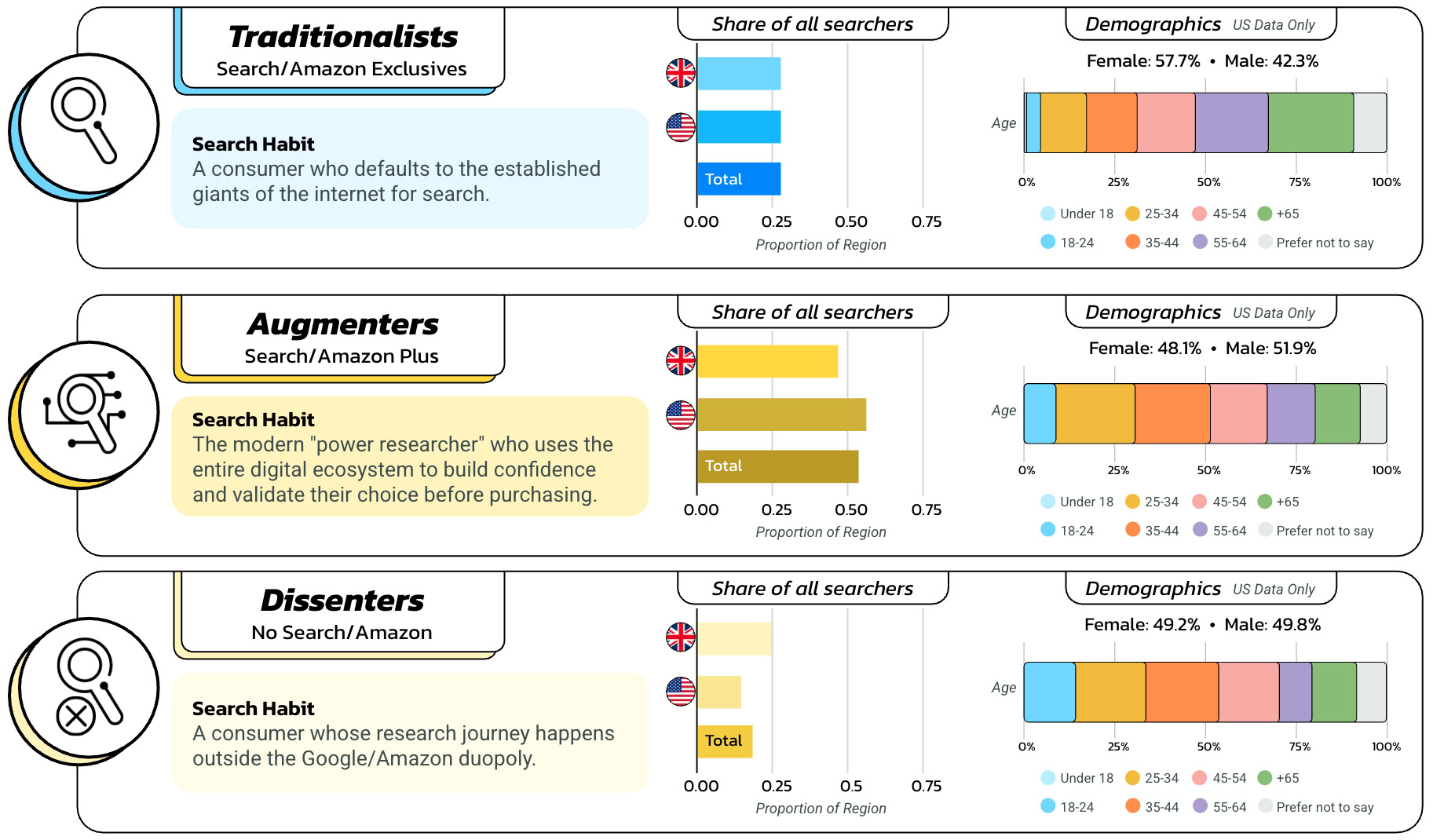

The Traditionalist: A significantly older demographic that sticks exclusively to the foundational giants of Google and Amazon, representing the most direct path to purchase.

The Augmenter: Our data reveals this is the largest segment, representing the mainstream consumer (25-44), who begins with Google or Amazon but then adds multiple other platforms like YouTube and AI chatbots.

The Dissenter: Our analysis identified a younger demographic that bypasses the duopoly altogether, discovering products organically on social and video platforms like TikTok and Instagram.

Understanding these three distinct journeys is critical for marketers, as each requires a unique channel strategy to ensure a brand’s message is coherent across the consumer’s bespoke path to purchase.

The Evolving World of Search: Beyond a Two-Platform Model

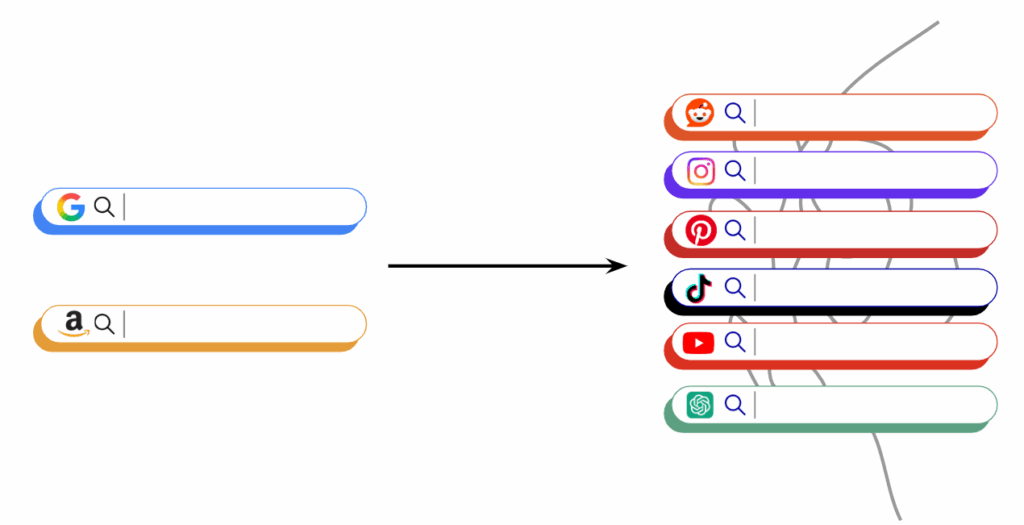

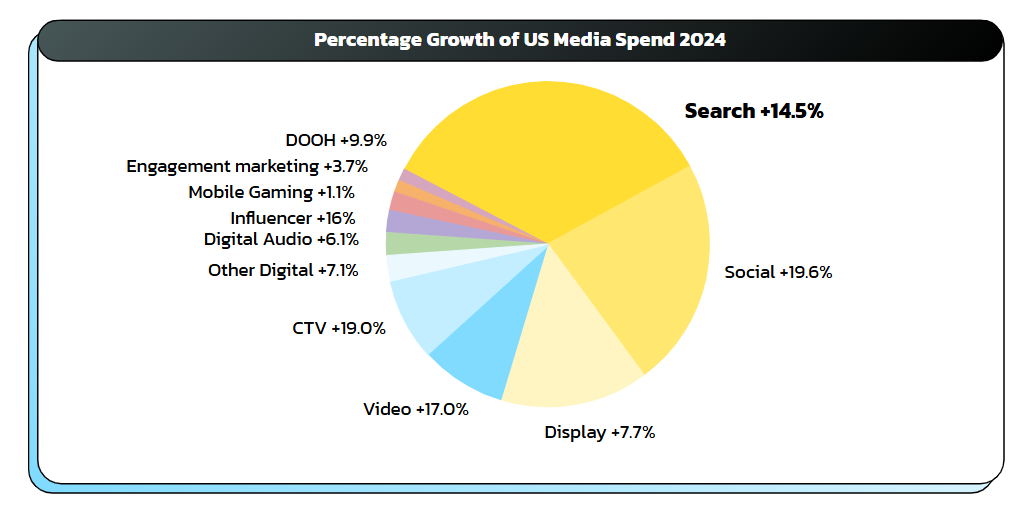

The prevailing wisdom is that we’re at a major inflection point for the world’s search habits. Search—the act of looking for information using text, images, or voice—has transformed . What was once a market dominated by the default choices of Google and Amazon has being fractured into a diverse ecosystem of platforms.

We’re told we’re living in a new era of ‘Social Search’ and ‘AI Search,’ where users are supplementing the traditional duopoly for a world of searching on platforms like TikTok, Reddit, and ChatGPT. As marketers, we’ve dutifully coined the new terms and accepted the premise that the old habits are dead, cynically perhaps because the new thing is always what sells to clients or internal stakeholders.

This diversification of platforms has been accompanied by a fundamental change in user behaviour. We’ve moved from a model where users relied on one or two primary platforms into a far messier world of touchpoints, with people using multiple channels in their search journeys.

And so the story goes: Google’s role is evolving, its habitual dominance being complemented by the rise of social and AI search, creating a more fragmented world for users and advertisers. The narrative is set. All that needs to be considered now is the critical question: is it actually true?

Answering this question is remarkably hard. It’s hard for two main reasons:

- Traditional measures of share of search focus on traditional search engines, they don’t include how often a user is using social or AI search. For example, see stat counter’s view of share of search.

- More cynically, none of these companies want to share data on their search volumes. Google and Amazon don’t want to suggest that their volumes are shrinking and the social and ai search platforms are benefiting from the prevailing narrative that they’re growing, why disavow the market of the belief that they’re claiming some of Google’s $175 billion1 in search revenues.

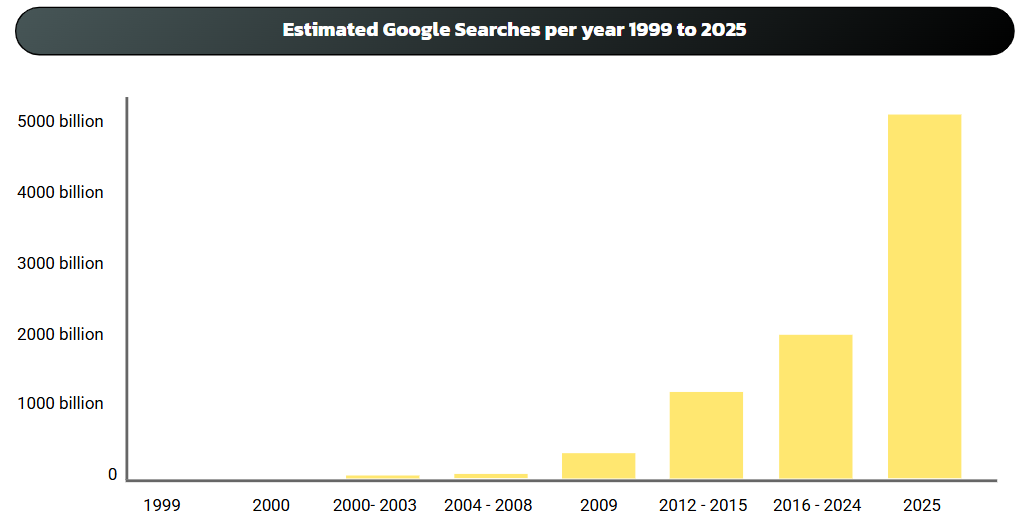

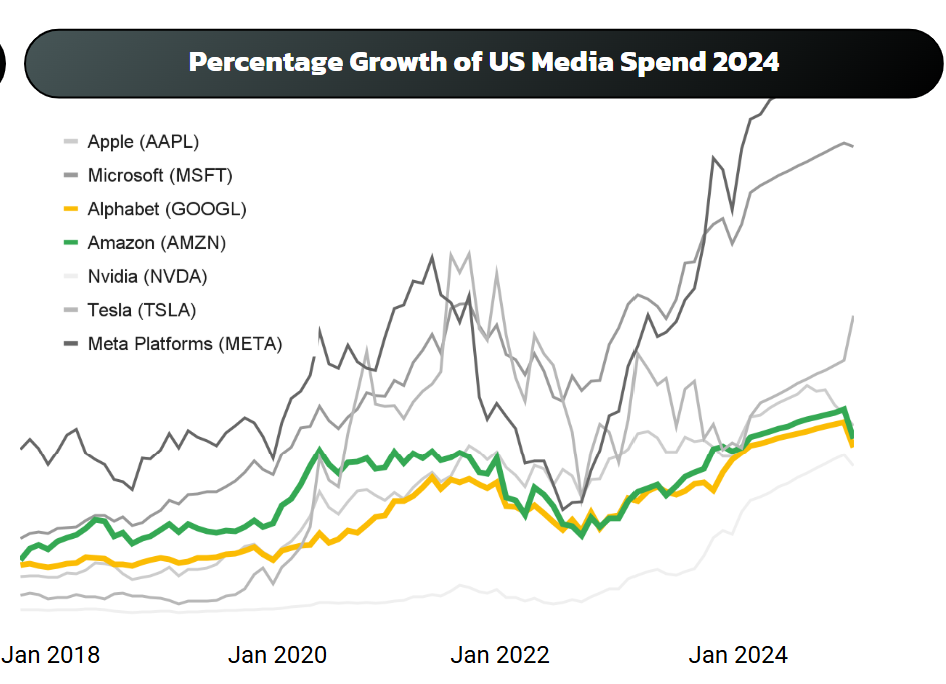

However, there is some evidence that Google might not be shrinking, implying that talk of their demise may at least be a little premature. Google searches are growing. Spend on Google isn’t dropping. Nor is their share price. And the “winners” seem a little quiet on the topic…

Google searches are growing.

Google searches are growing. Spend on Google isn’t dropping.

Google searches are growing. Spend on Google isn’t dropping. Nor is their share price.

Google searches are growing. Spend on Google isn’t dropping. Nor is their share price. And the “winners” seem a little quiet on the topic…

We set out to get a real representation of the search landscape today

To cut through the noise of unsubstantiated claims, we commissioned an in-depth survey of 3,000 representative consumers across the UK and the US. We focused on a key battleground in the search landscape: researching a recent product purchase.

Our survey was designed to capture the full complexity of a modern research journey by asking users about three key areas:

1. The Purchase Context: We first grounded each response in a real transaction by having users select from a comprehensive list of categories, from ‘Automotive’ to ‘Fashion & Accessories’.

2. The Platform Toolkit: To understand the full ecosystem, we then asked: ‘To do your research, which platforms did you use to search for information?’ This multi-select question included everything from Search Engines and Amazon to YouTube, TikTok, and AI Chatbots, revealing the complete ‘platform toolkit’ for each user.

3. Additional details – we asked users to identify where their journey started (‘Which platform did you use to start your search?’) and where it ended (‘On which platform did you make the final purchase?’). We also asked them to estimate how long it took to go from research to purchase.

Modern share of search platforms

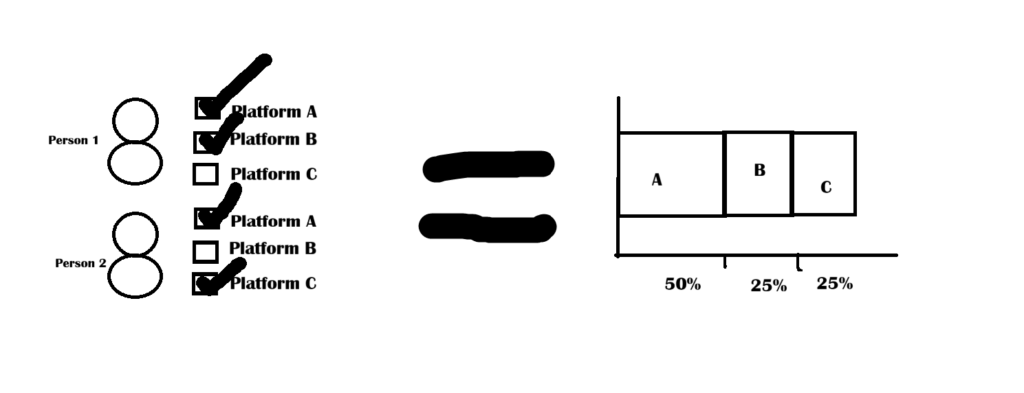

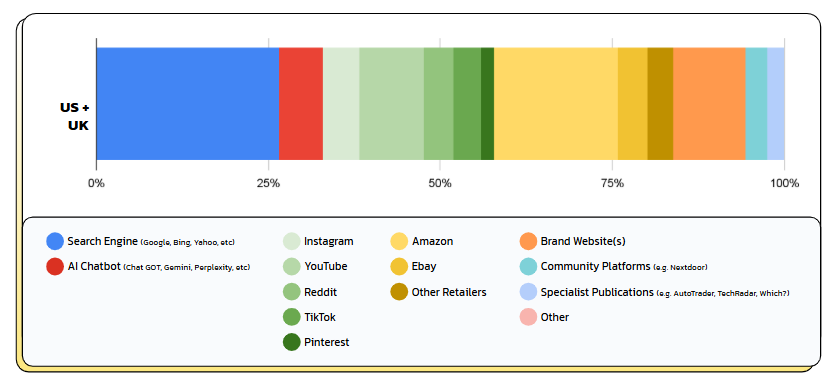

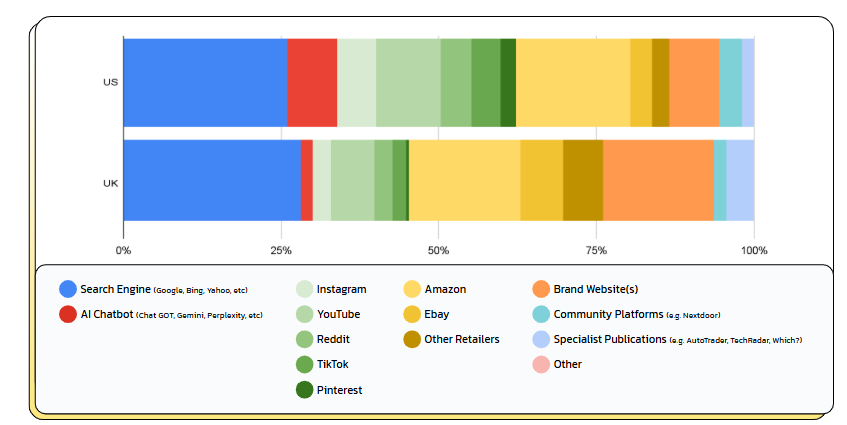

The data below illustrates the modern distribution of search platforms. The chart shows the “share of search platforms”— the proportion of all the platform touchpoints identified which were each of the platforms. E.g. if we counted up all platform touchpoints identified by users and had 10 in total, Google being 2 of these would give Google a share of 20%.

It’s important to note that our survey focused on which platforms were used, not the frequency of use. Our goal is to understand how the habit of turning to incumbents like Google and Amazon is evolving in this new, diversified landscape.

Insight #1 – The incumbents are bruised, not broken

Our survey results confirm that consumers are using a wide array of platforms for search. This in itself is noteworthy – AI platform search share is 6.3% across the dataset – impressive growth by any measure. We also see social search with high adoption as well. However, our data shows that the ingrained habits of using Google and Amazon remain formidable, as they command a significant share of search platform touchpoints (27%).

Another interesting finding is that the adoption of AI platform search share is more than four times higher in the US than in the UK (7.9% vs. 1.8%), with Social Search also showing higher adoption rates. This aligns with the common observation that the UK often lags behind the US in the adoption of new technology.

Insight #2 – Brand websites show a stronger foothold in the UK.

In our cross-country analysis, a key difference emerges in the role of brand-owned websites. In the UK, they represent a significant 17% of search touchpoints, more than double the 8% share in the US. This may be because lower adoption of social and AI search platforms like TikTok and ChatGPT in the UK means the traditional journey—which directs users out to third-party sites—remains more prevalent, directly benefiting brands.

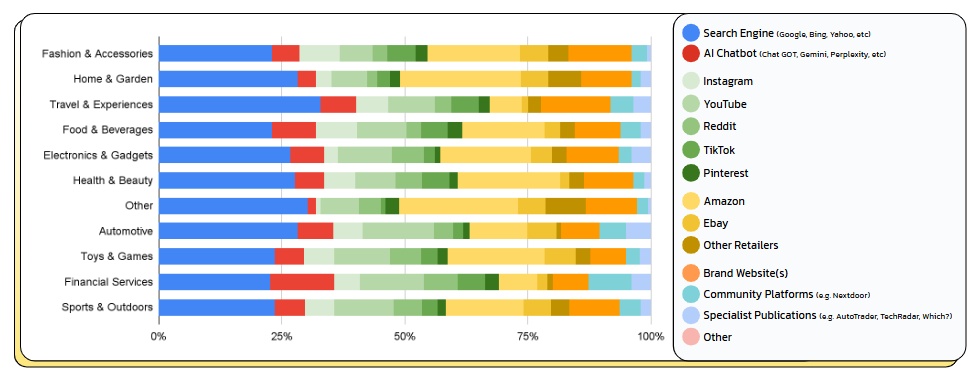

Insight #3: The story is one of curation, not chaos

Contrary to the narrative of a messy, endless journey, the average research path uses surprisingly few platforms, involving just 1.9 platforms in the UK and 2.5 in the US.

The real story is one of curation, not chaos.

Users are developing new, category-specific habits. For example, our data highlights the heavy use of AI when users consider financial services. This implies that instead of simply adding more steps, users are building efficient, personal “platform toolkits”—instinctively choosing the best platform for the specific task and their own search preferences.

Do note importantly that the combinations of platforms used in journeys was very variable – the implication being that you can’t really predict the journey, you have to plan for them all.

UK & US combined data

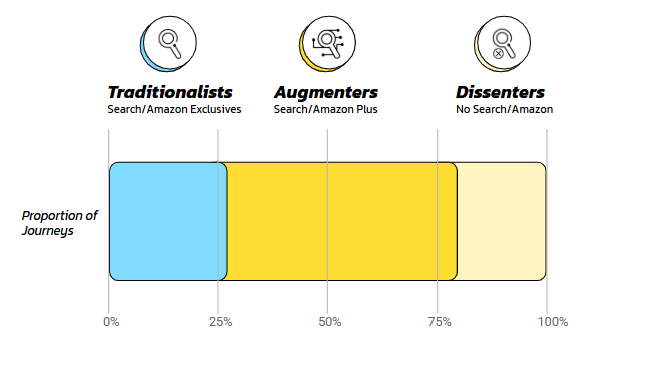

Patterns in the chaos – the traditionalist, the augmenter and the dissenter

The data provided by our survey paints a clear picture of a changing search landscape. We can assume 5-10 years ago it was just Google and Amazon, but now we have a much more diverse platform set in use. Understanding how this transition is happening, by examining not the aggregate but by looking at individual customer journeys, is essential for building robust communication and channel plans – ensuring we meet our customers where they are with a message which is coherent alongside those they’ve encountered on other search platforms.

Analyzing the nearly 3,000 individual journeys in our dataset, we have identified, we have identified three clear groups of users by looking at each research journey in our survey.

Deeper insight #1: Google and Amazon are still a part of 81% of journeys in total

Actionable takeaway: Audit you current media spends in search, if you’re spending >80% on Google and Amazon, think about trialing a recalibration to other platforms.

So whilst Google and Amazon combined make up only 45% of touchpoints across the dataset as we saw in Modern search’s platform share, they occur in 81% of user journeys, meaning that they are probably your best bet to manage to reach as many of your customers as possible on a very reduced platform set.

Deeper insight #2: Men are nearly twice as likely to use AI to augment their searches as women

Actionable takeaway: Pilot an “Answer Engine Optimization” (AEO) strategy, especially if your brand targets men and involves a complex, information-heavy purchase (like finance, auto, or tech)

Deeper insight #3: Social search adoption is high across genders, with 69% of men and 66% of women using a social platform.

Actionable takeaway: Treat your social channels as mid-funnel research platforms, not just top-of-funnel brand channels. Audit your content calendar to ensure your posts directly support product research.

Final Reflections

Our analysis of 3,000 consumer journeys reveals a search landscape that can be simplified into three core personas: the Traditionalist, who relies on the efficiency of the Google/Amazon duopoly; the Augmenter, who validates choices across a wide ecosystem; and the Dissenter, who bypasses the giants altogether. While these profiles provide a clear framework, they are generalizations. The Traditionalist journey is highly predictable, but our data shows the Augmenter and Dissenter groups contain hundreds of unique, individual platform combinations, revealing a vast “long tail” of personal research behaviors.

This complexity is best illustrated by the Dissenter. Our data shows this is not one group but two, with Dissenters in the US favoring a new ecosystem of social and AI discovery, while those in the UK navigate directly to brand and retail sites. This critical divergence proves that any effective marketing strategy must be local, modular, and built for the specific, nuanced ways different consumers are now finding their answers.

A Note from the Author

The method of dissent is local, which is key if this is the future of search

The “Dissenter” segment—those who bypass Google and Amazon—is not a single global persona. Our data reveals that Dissenters in the US and UK follow fundamentally different research paths, requiring distinct marketing strategies.

- When a US consumer bypasses the duopoly, they migrate to a new ecosystem of discovery platforms. The data shows:

– 46% use YouTube

– 28% use an AI Chatbot

- In contrast, when a UK consumer dissents, they follow a more traditional, direct path, favoring brand and retail websites they already know. The data shows:

– 50% visit a Brand’s Website

– 31% go directly to Other Retailers

This presents a fascinating paradox: the UK has a proportionally larger population of Dissenters, yet they use the “next-generation” social and AI platforms less than their US counterparts. This raises a critical question about the nature of the transition we are witnessing.

Why is this the case? The data suggests two competing hypotheses.

Hypothesis A: The US is a Time Machine

It’s possible that the transition to social and AI search is happening universally, drawing users away from all traditional touchpoints—not just Google and Amazon, but also from brand and retail sites. The difference we see today would simply be a consequence of this transition happening more quickly in the US.

Hypothesis B: The Cultural Divide is Real

An alternative hypothesis is that UK customers are on a different trajectory entirely. Our analysis consistently shows a higher UK preference for brand and specialist sites across all traditionalists, augmenters and dissenters. This may be a fundamental consumer trait, possibly driven by a greater mistrust of “big tech” aggregators or a cultural desire for more direct, controlled journeys.

Only future data, tracked over time, can definitively tell us whether the UK will follow the US path or if these two forms of “dissent” will continue to evolve in parallel. For now, marketers must acknowledge that the future of post-duopoly consumerism is not one-size-fits-all; it’s local.